What are cryptocurrencies? A beginner’s guide to digital money

Cryptocurrencies represent a revolutionary shift in how we perceive and use money. As digital assets that leverage cryptography for security, they have gained massive popularity in recent years. This guide aims to provide beginners with essential insights into the world of cryptocurrencies.

In this article, we will explore the fundamentals of cryptocurrencies, their workings, popular options, and the challenges they present. By the end, you’ll have a clearer understanding of what cryptocurrencies are and how to navigate this exciting yet complex financial landscape.

What Is Cryptocurrency?

Cryptocurrency is a type of digital currency that uses cryptographic techniques to secure transactions and control the creation of new units. Unlike fiat money, cryptocurrencies operate independently of a central authority, allowing for more freedom in financial transactions.

The primary technology behind cryptocurrencies is called blockchain, a decentralized ledger that records all transactions across a network of computers. This transparency helps in building trust among users while also preventing fraud.

Some of the most notable examples of cryptocurrency include Bitcoin, which is often referred to as «digital gold» due to its limited supply, and Ethereum, which goes beyond mere transactions by enabling the creation of smart contracts and decentralized applications.

How Does Cryptocurrency Work?

Cryptocurrencies function through a combination of cryptography and decentralized networks. When users perform a transaction, it is verified by a network of computers (also known as nodes) that maintain the blockchain.

The process of verifying transactions is known as mining, which involves solving complex mathematical problems. Once a transaction is verified, it gets added to the blockchain, ensuring that all users have access to the same information.

Cryptocurrencies also rely on public and private keys, which act as unique identifiers for each user. This enhances security, as only the wallet owner has access to their funds using their private key.

What Are The Popular Cryptocurrencies?

There are thousands of cryptocurrencies available, but a few have stood out due to their unique features and widespread adoption. Here are some of the popular cryptocurrencies you should know:

- Bitcoin (BTC): The first and most well-known cryptocurrency, often viewed as a store of value.

- Ethereum (ETH): Known for its smart contract functionality, allowing developers to create decentralized applications.

- Binance Coin (BNB): Originally created as a utility token for the Binance exchange, it now offers various functionalities within the Binance ecosystem.

- Ripple (XRP): Designed for facilitating cross-border payments efficiently and quickly.

- Cardano (ADA): Aimed at creating a more secure and scalable blockchain, focusing on sustainability and interoperability.

Each of these cryptocurrencies has its own set of features and uses, making them appealing to different types of users and investors.

Why Is Cryptocurrency Important?

The importance of cryptocurrency extends beyond just financial transactions. Here are several reasons why cryptocurrencies are gaining traction:

1. Decentralization: Operating without a central authority empowers users with more control over their finances. This decentralization is a key feature that attracts many individuals.

2. Lower Transaction Fees: Traditional financial systems often impose high fees for transactions, especially cross-border payments. Cryptocurrencies usually have lower fees, making them an economical alternative.

3. Financial Inclusion: Cryptocurrencies can provide access to financial services for people who are unbanked or underbanked, particularly in developing regions.

4. Transparency and Security: The blockchain technology underlying cryptocurrencies ensures that all transactions are transparent and secure, thus reducing the risk of fraud.

5. Innovation in Finance: Cryptocurrencies are at the forefront of innovations like decentralized finance (DeFi), which aims to create open financial systems without intermediaries.

What Are The Challenges And Risks Of Cryptocurrency?

Despite the numerous advantages, cryptocurrencies are not without their challenges and risks. Here are some of the key concerns:

1. Price Volatility: The value of cryptocurrencies can fluctuate dramatically within short periods, making them risky investments.

2. Regulatory Uncertainty: Different countries have varying regulations regarding cryptocurrencies, leading to confusion and potential legal issues for users and investors.

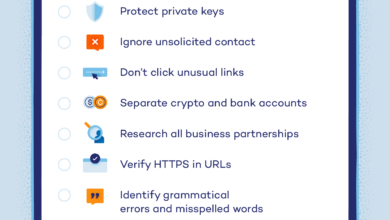

3. Security Risks: Although blockchain technology is secure, many exchanges and wallets have been hacked, resulting in significant losses for users.

4. Environmental Concerns: The energy consumption associated with cryptocurrency mining, especially Bitcoin, raises environmental sustainability issues.

5. Lack of Consumer Protections: Unlike traditional banks, cryptocurrency transactions are irreversible, meaning that once you send your funds, they cannot be recovered.

What Is The Future Of Cryptocurrency?

The future of cryptocurrency looks promising, with ongoing innovations in the field. Here are some trends to watch:

– Increased Adoption: As more businesses and individuals embrace cryptocurrencies, we can expect a broader acceptance of digital currencies in everyday transactions.

– Advancements in Blockchain Technology: Improvements in blockchain technology will likely enhance security and efficiency, making it more appealing for various applications.

– Regulatory Developments: As governments continue to formulate policies around cryptocurrencies, clearer regulations may lead to greater legitimacy and stability in the market.

– Integration with Traditional Finance: Traditional financial institutions are exploring ways to integrate cryptocurrencies into their services, which could enhance accessibility and usability.

How To Invest In Cryptocurrency For Beginners?

Investing in cryptocurrency can be both exciting and daunting for beginners. Here are some essential tips to consider:

1. Do Your Research: Before investing in any cryptocurrency, it’s crucial to understand its fundamentals, including the technology behind it and its market trends.

2. Choose a Reputable Exchange: Select a well-known and secure cryptocurrency exchange to buy and sell your digital assets.

3. Diversify Your Portfolio: Just like traditional investments, spreading your investments across various cryptocurrencies can help mitigate risks.

4. Start Small: Begin with a modest investment that you can afford to lose as you familiarize yourself with the market.

5. Stay Informed: Keep up-to-date with the latest news and developments in the cryptocurrency space to make informed investment decisions.

Questions related to cryptocurrency investment

What Are The Basics Of Cryptocurrency For Beginners?

The basics of cryptocurrency involve understanding that it is a digital currency secured by cryptography. This means transactions are verified and recorded on a decentralized network called a blockchain. Beginners should familiarize themselves with key concepts like wallets, private keys, and the various types of cryptocurrencies available.

Moreover, it’s essential to learn about the differences between different cryptocurrencies and what unique features they offer. For example, while Bitcoin is primarily used as a store of value, Ethereum enables the development of decentralized applications through smart contracts.

Can You Make $1000 A Month With Crypto?

Making $1000 a month through cryptocurrency is possible, but it comes with significant risks. Many investors attempt to achieve this through trading, which involves buying and selling cryptocurrencies based on market trends. However, success in trading requires a deep understanding of the market and can often lead to losses.

Additionally, some individuals earn income through staking or providing liquidity to decentralized finance (DeFi) platforms, which can yield returns. Nevertheless, it’s essential to remember that cryptocurrency investments are volatile and can vary widely, so consistent earnings are not guaranteed.

Is Crypto Real Money?

Whether cryptocurrency is considered «real money» often depends on context. While it can be used for transactions and has value, it is not universally accepted as legal tender like traditional currencies. Some businesses accept cryptocurrencies as payment, while others do not.

Moreover, cryptocurrencies operate on decentralized networks, meaning their value is determined by market demand rather than being backed by any government or physical asset. This uniqueness contributes to the debate about their status as «real money,» and opinions on the matter vary widely.

Can You Make $100 A Day With Crypto?

Making $100 a day with cryptocurrency is also possible but highly dependent on market conditions and individual trading strategies. Active traders might achieve this through day trading, which involves buying and selling assets within a single trading day based on short-term price movements.

However, it is crucial to approach such strategies with caution, as the volatility of the cryptocurrency market can lead to significant losses. For beginners, focusing on long-term investments rather than trying to make daily profits might be a more sustainable strategy.

Overall, understanding the fundamentals and risks associated with cryptocurrencies is vital for anyone looking to invest or participate in the growing digital economy.