Understanding stablecoins: how they work and why they matter

Stablecoins are a unique type of cryptocurrency designed to maintain a stable value, often pegged to traditional fiat currencies like the US Dollar. They address the inherent volatility seen in more established cryptocurrencies, such as Bitcoin, making them an attractive option for many users. In this article, we will explore the fundamental aspects of stablecoins, including their functionality, significance, types, and risks, thereby shedding light on Understanding Stablecoins: How They Work and Why They Matter.

As digital assets continue to gain traction in the financial landscape, stablecoins are emerging as vital components, facilitating smoother transactions and enhancing financial stability. This article aims to provide insights into the various dimensions of stablecoins and their roles in today’s economic environment.

What are stablecoins and how do they work?

Stablecoins are cryptocurrencies designed to offer price stability by linking their value to a reserve of assets, such as fiat currencies, commodities, or other cryptocurrencies. This pegging mechanism ensures that the value of stablecoins remains relatively constant, unlike more volatile digital currencies.

Generally, stablecoins can be classified into several categories based on how they maintain their stability. Fiat-collateralized stablecoins, for example, are backed by reserves of traditional currency, ensuring that every stablecoin is equivalent to a specific amount of fiat. Conversely, crypto-collateralized stablecoins are backed by other cryptocurrencies, while commodity-backed stablecoins derive their value from physical assets like gold.

- Fiat-collateralized stablecoins

- Crypto-collateralized stablecoins

- Commodity-backed stablecoins

- Algorithmic stablecoins

Understanding Stablecoins: How They Work and Why They Matter involves recognizing their operational mechanisms, which typically include smart contracts that execute transactions automatically according to predefined conditions.

Why are stablecoins so important?

The importance of stablecoins lies in their potential to bridge the gap between traditional financial systems and the emerging world of cryptocurrencies. They provide users with a reliable medium of exchange that can be utilized for everyday transactions, thus enhancing financial inclusivity.

Moreover, stablecoins can facilitate cross-border payments with lower fees and faster transaction times compared to traditional payment systems. This efficiency can be particularly beneficial for users in regions with limited access to banking services, offering them a viable alternative for conducting transactions.

Additionally, stablecoins help mitigate risks associated with market volatility, offering a safe haven for investors during uncertain times. Their growing adoption is also prompting regulatory bodies, like the Bank of England, to consider frameworks to ensure consumer protection.

What are the different types of stablecoins?

Stablecoins can be categorized into four main types based on their underlying mechanisms:

- Fiat-collateralized stablecoins: These stablecoins maintain their value by being backed 1:1 by fiat currencies, providing a stable anchor.

- Crypto-collateralized stablecoins: Backed by other cryptocurrencies, these stablecoins often require over-collateralization to manage volatility.

- Commodity-backed stablecoins: These are pegged to commodities like gold or oil, ensuring that their value reflects that of physical assets.

- Algorithmic stablecoins: They utilize algorithms and smart contracts to manage supply and demand, maintaining stability without collateral.

Each type of stablecoin comes with its unique advantages and disadvantages, impacting how they are utilized in various financial scenarios. For instance, while fiat-collateralized stablecoins are often deemed the safest, algorithmic stablecoins can be more susceptible to market fluctuations.

How do stablecoins facilitate transactions?

Stablecoins streamline the payment process, providing users with a more efficient alternative to traditional currencies. They allow for instant transactions, reducing the time taken for payments to settle, which is crucial for businesses operating in a globalized economy.

Moreover, the integration of stablecoins into payment systems offers several advantages, such as:

- Lower transaction fees: Compared to traditional banking systems, stablecoin transactions typically incur lower fees.

- Increased accessibility: Users without access to conventional banking can utilize stablecoins for online transactions.

- Global reach: Stablecoins facilitate cross-border transactions without the need for currency conversion.

By leveraging stablecoins, businesses can enhance operational efficiency and improve customer satisfaction, making them an attractive option in the ever-evolving landscape of digital payment systems.

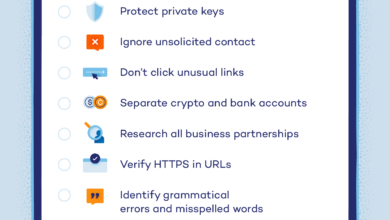

What are the risks associated with stablecoins?

Despite their advantages, stablecoins are not without risks. One significant concern is the lack of regulation, which can lead to potential fraud or mismanagement of reserves. As stablecoins continue to grow in popularity, regulatory bodies are increasingly scrutinizing their practices.

Additionally, the underlying collateral supporting stablecoins can be vulnerable to market fluctuations. For example, crypto-collateralized stablecoins might face volatility if the price of the backing cryptocurrency decreases significantly.

Some of the key risks associated with stablecoins include:

- Regulatory uncertainty: The ongoing evolution of regulations might affect the operation and acceptance of stablecoins.

- Transparency issues: Users may not always have access to information regarding the collateral backing their stablecoins.

- Liquidity risks: In times of market stress, redeeming stablecoins for fiat or other assets might become challenging.

Investors and users should remain vigilant regarding these risks and seek stablecoins that provide regular audits and transparency into their reserves.

How can stablecoins be used in everyday life?

Stablecoins can vastly improve day-to-day financial interactions by offering a reliable and efficient payment method. Here are a few examples of how stablecoins are transforming everyday transactions:

- Online purchases: Many e-commerce platforms are beginning to accept stablecoins as a form of payment, allowing for seamless transactions.

- Remittances: Stablecoins can facilitate low-cost remittances, helping individuals send money home without exorbitant fees.

- Smart contracts: Utilizing stablecoins within smart contracts enables automated transactions based on predefined conditions.

Furthermore, stablecoins can serve as a store of value, providing users with a safe way to hold their assets without worrying about price fluctuations. As digital assets continue to evolve, stablecoins are likely to play an increasingly central role in the economic landscape.

Related questions about stablecoins and their importance

What are the 4 types of stablecoins?

The four primary types of stablecoins include fiat-collateralized, crypto-collateralized, commodity-backed, and algorithmic stablecoins. Each type employs different mechanisms to maintain value stability, making them suitable for various use cases in the financial ecosystem.

What is a stablecoin and how does it work?

A stablecoin is a type of cryptocurrency designed to maintain a stable value, often pegged to a fiat currency or another asset. They work by utilizing mechanisms like reserves or algorithms to ensure their price stability, providing a more reliable means of transaction compared to traditional cryptocurrencies.

Why do stablecoins matter?

Stablecoins matter due to their potential to enhance financial stability and facilitate transactions in a more efficient manner. They bridge the gap between traditional finance and the digital currency landscape, offering a reliable medium of exchange that can help democratize access to financial services.

How to make money from stablecoins?

Investors can earn returns on stablecoins through various means, such as lending them on decentralized finance (DeFi) platforms, where they can generate interest on their holdings. Additionally, some stablecoins offer incentives or rewards for holding them in specific wallets, providing users with opportunities to profit.